Introduction

The FINNIFTY weightage is a vital aspect of India’s financial markets, especially for those interested in the Nifty Financial Services Index. Understanding FINNIFTY weightage helps investors assess the impact of specific stocks on the index’s movement, providing valuable insights into market trends and sector performance. Comprising companies from the banking, financial services, and insurance sectors, the FINNIFTY index captures the pulse of India’s financial industry. This guide will dive into the importance of FINNIFTY weightage, its composition, and how it can help investors make informed decisions.

What is FINNIFTY?

To understand FINNIFTY weightage, it’s essential to know what FINNIFTY represents. FINNIFTY, or the Nifty Financial Services Index, is a sectoral index on the National Stock Exchange of India (NSE) focusing on financial services companies. It includes banks, insurance companies, non-banking financial companies (NBFCs), and other financial institutions. FINNIFTY weightage reflects how much influence each stock has within the index, directly impacting its performance based on stock price changes in top-weighted stocks.

Importance of FINNIFTY Weightage

The FINNIFTY weightage is crucial as it determines the impact of each stock on the index’s overall movement. For example, stocks with a higher FINNIFTY weightage, like top banks or financial institutions, will have a larger influence on index fluctuations than those with lower weightage. Understanding FINNIFTY weightage helps investors recognize which stocks primarily drive the index, allowing them to predict and strategize around market movements more effectively.

Composition of FINNIFTY Index

The composition of FINNIFTY weightage includes a variety of companies from India’s financial sector. It features stocks from leading banks, NBFCs, and insurance firms, each contributing a specific weight to the overall index. FINNIFTY weightage typically leans heavily on banking stocks, followed by NBFCs and insurance companies. The index is periodically reviewed to reflect current market conditions, with stocks entering or exiting based on factors like market capitalization and sector performance.

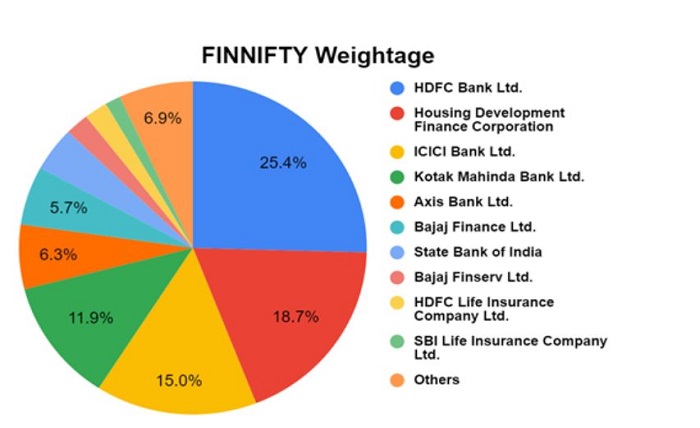

Top Holdings in FINNIFTY Weightage

Understanding the top holdings in FINNIFTY weightage is essential, as these stocks significantly influence the index’s performance. Some of the highest-weighted stocks in the FINNIFTY index are from major banks like HDFC Bank, ICICI Bank, and State Bank of India. Non-banking financial companies like Bajaj Finance and insurance companies like HDFC Life also have notable FINNIFTY weightage. Monitoring these top holdings helps investors keep track of stocks that drive the index’s performance and informs strategic decisions based on their price movements.

Sectoral Breakdown of FINNIFTY Weightage

The finnifty is divided into three primary sectors: banking, NBFCs, and insurance. The banking sector generally holds the largest FINNIFTY weightage, making it the primary driver of the index’s movements. NBFCs also play a crucial role, with significant FINNIFTY weightage distributed among companies providing lending and financial services. Insurance stocks contribute as well, offering stability to the index due to their defensive nature. This sectoral breakdown is essential to understand how market shifts in each sector can impact FINNIFTY.

Factors Influencing FINNIFTY Weightage

Several factors influence FINNIFTY weightage, affecting the index composition and the weight assigned to each stock. Market capitalization is a primary determinant, as companies with higher market caps have greater weightage in FINNIFTY. Additionally, liquidity and trading volume are considered to ensure stocks are actively traded. Economic conditions, policy changes, and corporate performance also impact the individual stock performance within FINNIFTY weightage, leading to periodic adjustments to keep the index aligned with market trends.

How FINNIFTY Weightage Affects Index Performance

The performance of the FINNIFTY index is heavily impacted by FINNIFTY weightage distribution. Stocks with higher weightage have a more substantial influence on index movements, meaning price changes in these stocks directly impact FINNIFTY’s value. For instance, a surge in a high-weighted stock like HDFC Bank could boost the entire index, while a drop in the same stock might pull the index down. Thus, FINNIFTY weightage is a crucial metric for understanding how specific stocks drive the overall market sentiment.

FINNIFTY Weightage and Investment Strategies

Understanding FINNIFTY weightage plays an important role in creating effective investment strategies. Investors can analyze FINNIFTY weightage to identify high-impact stocks and sectors, allowing them to anticipate index movements and strategize accordingly. For example, if the FINNIFTY weightage leans heavily on banking stocks, an investor might choose to align their portfolio with these high-weight sectors to capitalize on potential gains. Alternatively, knowing which stocks have lower FINNIFTY weightage can help risk-averse investors opt for a more balanced approach.

Adjustments in FINNIFTY Weightage

The FINNIFTY weightage is periodically reviewed and adjusted to ensure it reflects current market dynamics. These adjustments account for changes in stock performance, market capitalization, and other factors that impact the financial sector. Adjustments in FINNIFTY weightage may result in the inclusion or exclusion of stocks, with rebalancing occurring to maintain accurate representation of the financial sector. Understanding these periodic adjustments is essential for investors to stay aligned with the current composition and weightage trends of FINNIFTY.

Why FINNIFTY Weightage is Important for Investors

For investors, understanding FINNIFTY weightage offers valuable insights into the market’s structure and movement. By analyzing FINNIFTY weightage, investors can identify key stocks that drive the index, anticipate sector-specific trends, and make data-driven decisions. Additionally, tracking FINNIFTY weightage allows investors to align their portfolios with sectors that hold higher weight, enhancing their ability to capture gains from high-performing stocks within the financial sector. This knowledge empowers investors to create well-informed, effective strategies based on the current weightage distribution in FINNIFTY.

Conclusion

The FINNIFTY weightage serves as a key tool for investors to understand and navigate the Nifty Financial Services Index. By recognizing the weightage distribution among different stocks and sectors, investors can anticipate market movements, make informed decisions, and develop strategies aligned with FINNIFTY’s performance. From understanding the influence of top-weighted stocks to exploring sector-specific impacts, FINNIFTY weightage offers insights that benefit both novice and experienced investors. Whether you’re investing in financial services or using the index for market analysis, FINNIFTY weightage provides the necessary insights to optimize your approach in India’s dynamic financial market landscape.

FAQs

1. What is FINNIFTY weightage?

FINNIFTY weightage refers to the specific influence each stock has within the Nifty Financial Services Index. Higher weightage stocks have a greater impact on the index’s performance, directly affecting its value based on their price movements.

2. Which sectors dominate FINNIFTY weightage?

The FINNIFTY weightage is dominated by the banking sector, followed by NBFCs (Non-Banking Financial Companies) and insurance companies. Banking stocks generally have the highest weightage, making them the primary drivers of the index’s performance.

3. How is FINNIFTY weightage determined?

FINNIFTY weightage is determined primarily by market capitalization, meaning stocks with higher market caps receive greater weight. Other factors like liquidity, trading volume, and periodic adjustments also influence the weightage distribution within FINNIFTY.

4. Why is FINNIFTY weightage important for investors?

Understanding FINNIFTY weightage helps investors identify high-impact stocks, anticipate sector movements, and develop informed strategies. By analyzing FINNIFTY weightage, investors can align their portfolios with dominant sectors, enhancing their potential for gains in the financial market.

5. How often is FINNIFTY weightage reviewed and adjusted?

The FINNIFTY weightage is periodically reviewed to maintain an accurate reflection of market conditions. Adjustments are made based on factors like stock performance, market capitalization, and sector dynamics, ensuring that the FINNIFTY index remains aligned with the financial sector’s current landscape.